LAHORE: (Web Desk) Government has launched the Roshan Apna Ghar Scheme for overseas Pakistani.

Overseas Pakistan can now apply for buying a house and for that purpose they have the facility for complete bank financing for this purpose.

Overseas Pakistan can also sell or buy the house under Roshan Apna Ghar Scheme.

State Bank of Pakistan (SBP) with the collaboration of eight major banks in the country will finance the overseas Pakistani’s investment in the housing project in Pakistan. The financing is available in both conventional and Shariah-compliant variants at attractive rates for a period of 3-25 years.

The Overseas Pakistanis will be facilitated with a digital payment system, that is, they can open their bank accounts without visiting a bank, embassy, or consulate.

These accounts can also be used for savings in the stock market and property within Pakistan. The customers would also have the option to either open a Pakistan currency or foreign currency accounts.

Complete Guide to Apply For Roshan Apna Ghar Scheme

First, overseas Pakistanis first need to open the Roshan Digital Account (RDA) using their own funds by visiting the Roshan Ghar page of RDA contributes banks. The banks include UBL, Bank Alflah, HBL, MCB, BOP, Meezan Bank and Bank Alhabib.

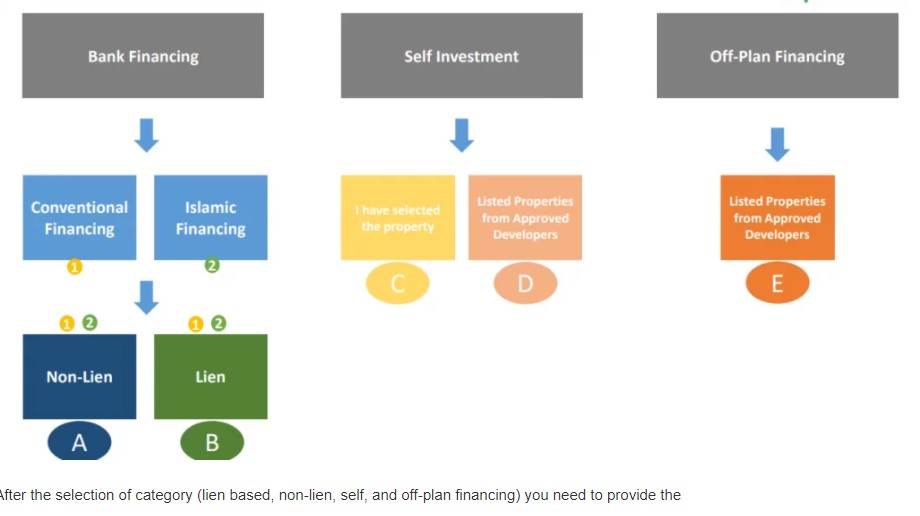

One can apply for buying a house via one’s own investment or obtaining bank financing digitally by using the following options:

- Lien based Financing

- Non-Lien based Financing

- Self Financing

- Off-Plan Financing

To open the RDA account the applicant can visit any affiliated bank and click on “apply now” and provide all personal details correctly.

Once the RDA account is live, you can easily apply for the Roshan Apna Ghar scheme under the given categories.

After a category is selected (lien based, non-lien based, self and off-plan financing) you are required to provide the personal details.

Property details

Income details for assessment (e.g., salary slip, bank statement, employer certificate, etc)

Nominee Type, CNIC, Email ID, Mobile No. NTN and the required documents.

Once the complete information is provided, you need to agree to the Terms and Conditions and submit the form.

You will also get a call from a bank representative for the application process.

Once your application status is approved you will be able to get Rs. 5,000,000 financing from the bank.

For more information visit: https://www.sbp.org.pk/RDA/Ghar